salt tax cap explained

State Responses to the 10000 SALT Cap. How does the property tax deduction differ from the overall SALT deduction.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

. The District of Columbia New Hampshire New York City Tennessee and. Taxpayers who are impacted by the SALT limitthose taxpayers who itemize deductions and who paid state and local taxes in excess of the SALT limitmay not be required to include the entire state or local tax refund in income in the following year. As alternatives to a full repeal of the cap lawmakers and.

December 12 2021 930 AM 4 min read. How to lower your chances of an IRS tax audit 0252. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A.

A key part of that. The SALT deduction tends to benefit states with many higher-earners and higher state taxes. The SALT cap was put in place by the 2017 tax law to help defray the costs of tax rate cuts including the cutting of the top individual rate from 396 percent to 37 percent As.

Making sense of the new cap on state tax deductions. The Tax Cuts and Jobs Act placed a temporary cap on the SALT deduction and that cap is set to end after the tax year 2025. Given that 10000 cap on the SALT deduction you would need to find more than 2200 in deductions elsewhere to.

If Congress does not make permanent the individual tax provisions the SALT deduction cap of 10000 per household will. The federal tax reform law passed on Dec. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal.

As incomes rise the loss in deductions can also be offset by the decrease of the top federal income tax rate from. 12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT. The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020.

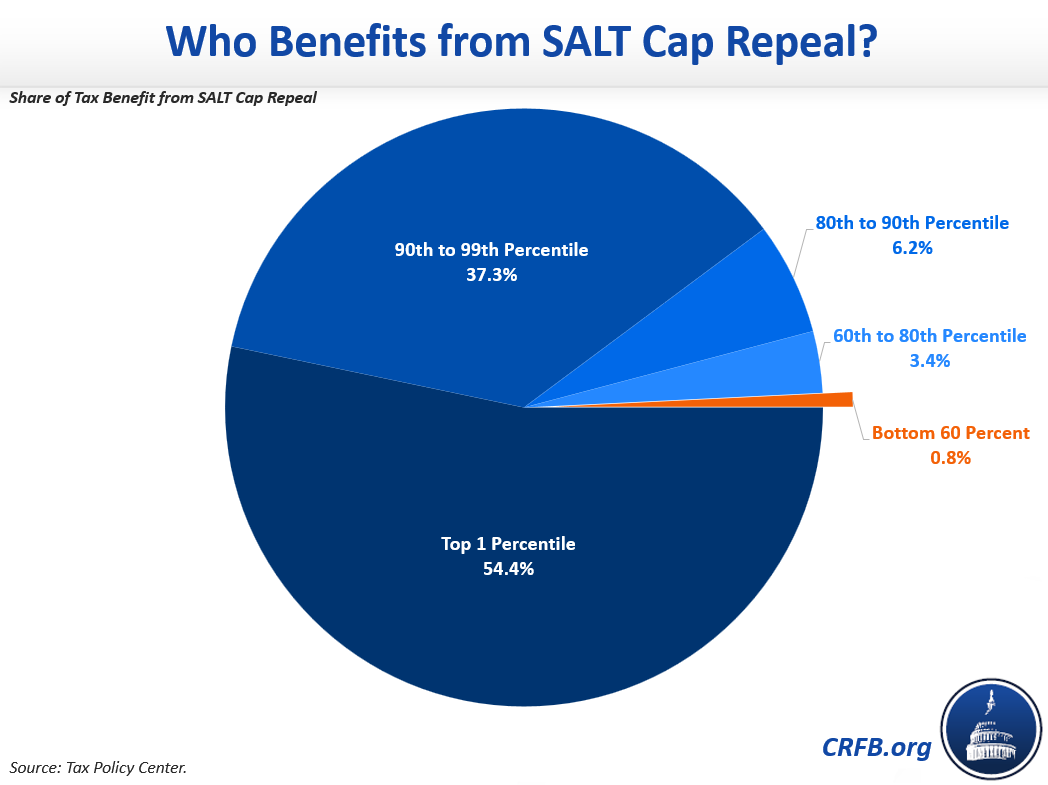

21 hours agoThree House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. In 2018 Trump placed a cap on the SALT deduction in order to recover revenue lost from various tax cuts. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut of 2640.

More than 20 Democrats. Now the SALT tax cap is set to expire in 2025. But some policymakers are pushing to get rid of it.

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. Higher-tax states such as California New York New Jersey and Pennsylvania. Ways the SALT deduction cap can be offset for high earners.

This was true prior to the SALT deduction cap and remained the case in 2018. Leaders are trying to. For your 2021 taxes which youll file in 2022 you can only itemize when your.

The change may be significant for filers who itemize deductions in. The SALT Deduction is currently capped at 10000 so if youre paying more than that in local taxes you wont be able to remove that from your reported income. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize.

The rich especially the very rich. The GOP tax bill explained. State and Local Tax SALT tax deduction cap explained.

States and municipalities imposing entity-level taxes on PTEs are not new. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. About 256 million fewer tax returns used the SALT deduction the year after the cap was put in place.

224 PM ET. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. As for the House bills 10000 cap on the property tax deduction the average deduction claimed.

By Kathryn Vasel KathrynVasel December 20 2017.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Deduction Resources Committee For A Responsible Federal Budget

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

The Salt Cap Overview And Analysis Everycrsreport Com

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How To Deduct State And Local Taxes Above Salt Cap

State And Local Tax Salt Deduction Salt Deduction Taxedu

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget